The iGaming industry is experiencing unprecedented growth, but beneath the surface, card payment costs are crushing operator margins. Discover how to help operators reduce overheads, increase revenue, fight fraud, and boost conversions.

If you're a payments service provider (PSP) serving iGaming operators, up to 5% transaction fees and record fraud losses on player deposits are squeezing both your and your clients' profits. Many forward-thinking PSPs have found their solution: open banking payments (Pay by Bank). While competitors battle over shrinking card margins, early adopters are offering lower costs, no chargebacks, and better conversion rates that actually grow revenue. Are you one of them?

In this article, we examine how offering iGaming deposits via Pay by Bank creates a genuine competitive advantage for PSPs ready to move beyond the limitations of cards. You'll discover how integrating open banking into your payment services portfolio could be your fastest and simplest path to higher margins and accelerated growth.

The growing payments pressure in iGaming

Card transaction fees are squeezing margins

The iGaming sector's relationship with card payments has reached a breaking point. Card networks and issuing banks increasingly view gambling transactions as high-risk, even in markets with significant and robust regulation like the UK and EU. This means that despite ever-tightening regulations, payment costs in iGaming are still eye-wateringly high. These high costs reduce margins for both PSPs and operators, limiting their ability to remain competitive by reinvesting in growth opportunities and maintaining a cutting-edge service.

The iGaming sector's relationship with card payments has reached a breaking point. Card networks and issuing banks increasingly view gambling transactions as high-risk, even in markets with significant and robust regulation like the UK and EU. This means that despite ever-tightening regulations, payment costs in iGaming are still eye-wateringly high. These high costs reduce margins for both PSPs and operators, limiting their ability to remain competitive by reinvesting in growth opportunities and maintaining a cutting-edge service.

Poor payment experiences impact conversion rates

High decline rates and poor payment flow UX represent a substantial challenge affecting the entire industry. According to recent player experience data from Fluid Payments, 52% of players have faced payment declines when signing up for new gaming apps, and 33% say drawn-out deposit processes are their number one frustration. Corefy's 2024 research found that nearly one-third of gambling businesses face frequent payment downtime, which directly impacts revenue, player experience, and retention. In an industry where cost-per-acquisition can be £50 or more, even small reductions in drop-offs can have a substantial compound benefit. And acquisition costs are rising as global betting and gaming markets become increasingly competitive, putting more strain on operators to drive efficiency and ROI in their acquisition efforts.

Rising fraud crisis is squeezing margins

Fraud has reached alarming levels in the iGaming sector. Sumsub's 2024 iGaming Fraud Report reveals that fraud in the online gaming sector increased by an average of 64% year-over-year between 2022 and 2024. Traditional card payments expose iGaming operators to bonus and chargeback fraud.

Fraud has reached alarming levels in the iGaming sector. Sumsub's 2024 iGaming Fraud Report reveals that fraud in the online gaming sector increased by an average of 64% year-over-year between 2022 and 2024. Traditional card payments expose iGaming operators to bonus and chargeback fraud.

Nearly 70% of all fraud incidents in iGaming are bonus fraud, while 5.6% are chargebacks. However, chargebacks can account for a higher actual loss than bonus fraud, as they can be triggered on payments of any amount — potentially leading to losses of thousands in one false claim. Additionally, each chargeback incurs substantial financial losses for an operator, extending beyond the transaction amount to include chargeback fees and potential fines from card networks.

Key takeaway: The payment crisis impact

The numbers tell the story: Up to 5% transaction fees + 52% payment declines + 64% fraud increase = unsustainable pressure on PSP and operator margins. Traditional cards are becoming a competitive liability in iGaming.

How Pay by Bank helps iGaming operators overcome payment challenges

What is Pay by Bank?

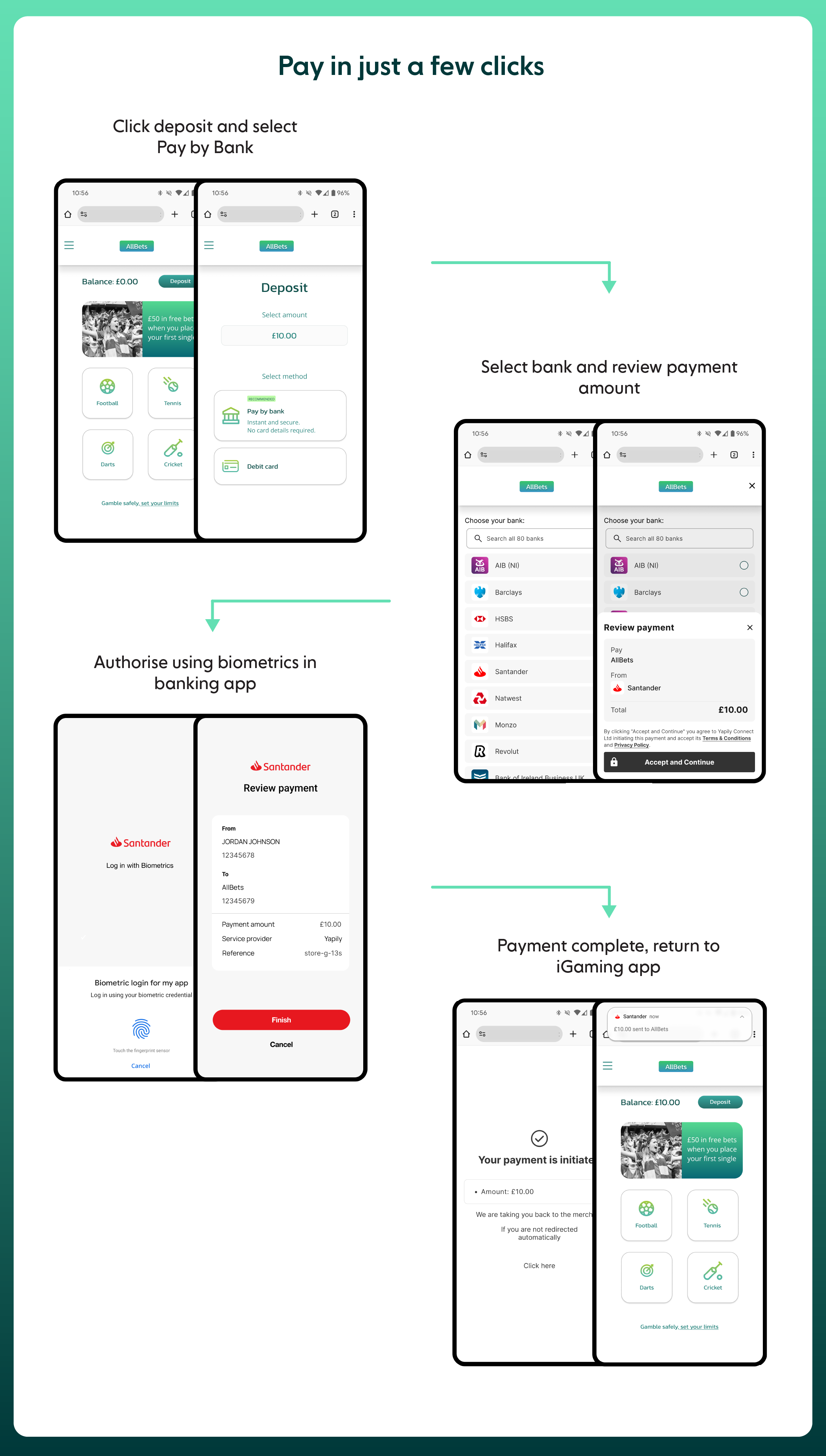

Pay by Bank leverages open banking technology to enable direct bank-to-operator transfers, completely bypassing traditional card networks. Instead of needing to enter card details, players authenticate directly through their banking app using bank-grade biometric security verification, then authorise the payment in seconds.

Bypassing cards means lower costs and higher margins

As Pay by Bank bypasses card network fees entirely, it enables providers to offer payments at a fraction of the cost of card payments — even for “high risk” industries. This cost reduction is a game-changer for your business, allowing you to offer competitive pricing that helps win new clients by directly improving their bottom lines.

Even modest Pay by Bank adoption can deliver significant savings for operators. With an average transaction fee of between 2% and 5%, Pay by Bank can reduce this cost by upto 70%.

An operator that makes Pay by Bank their preferred deposit method can see significant cost savings. This is the kind of value proposition that can build long-term partnerships with iGaming operators.

Pay by Bank improves conversion, reducing cost-per-acquisition

iGaming deposits powered by Pay by Bank cut through the complexity that's killing conversions. No more asking players to dig out their wallets, type in 16-digit card numbers, remember security codes, or navigate confusing security pop-ups. Instead, click "Pay by Bank", select their bank, authenticate with their fingerprint or face ID in their familiar banking app, and they're done. The whole process takes seconds.

For your operators, this low-friction payment method translates directly into improved first-deposit success rates. When you consider customer acquisition costs in iGaming, even a modest 10% improvement in conversion means your operators will be getting significantly more value from their marketing spend. This proposition is even more critical during peak times like major sporting events, when convoluted payment processes with traditional payment systems can turn players off.

Additionally, Pay by Bank offers a fallback alternative for when card payments fail. Given that 52% of players have faced payment declines when signing up for new apps, providing seamless redirection to open banking can dramatically improve overall conversion rates and customer satisfaction.

This is the kind of demonstrable ROI that will make you their go-to PSP.

Prevent chargebacks and reduce bonus fraud

When a player authenticates directly with their bank to make a payment, they can't later claim they didn't authorise it. There's no card network to dispute through, no friendly fraud possibilities, and no chargeback fees eating into your operators' profits.

For your operators, this means no more budgeting for chargeback losses, no more administrative overheads for managing disputes, and no more surprise hits to monthly profits.

Multi-account bonus fraud that costs operators millions is also more difficult when players need to authenticate with their actual bank account using secure customer authentication (SCA). Banks have already done the heavy lifting on identity verification — they know exactly who owns each account. This means your operators get bank-level verification without any additional compliance overhead.

Compare this to card payments, where fraudsters can easily use different stolen or cloned cards to create multiple accounts and farm bonuses. With Pay by Bank, they'd need access to multiple bank accounts — a much higher barrier that effectively eliminates this type of fraud.

Breaking down the benefits of Pay by Bank for both PSPs and their operators

Benefit | Card payments | Pay by Bank (open banking |

|---|---|---|

Operator benefits | ||

Transaction costs |

|

|

Conversion rates |

|

|

Fraud protection |

|

|

User experience |

|

|

Revenue predictability |

|

|

Marketing ROI |

|

|

Compliance overhead |

|

|

PSP benefits | ||

Processing margins |

|

|

Competitive position |

|

|

Client acquisition |

|

|

Pricing power |

|

|

Market opportunity |

|

|

Geographic expansion |

|

|

Revenue growth |

|

|

Key takeaway: The triple win for PSPs

A game-changing value proposition: Pay by Bank delivers significantly lower transaction costs and improved conversion rates with zero chargeback risk. This isn't just another payment method — it's your competitive differentiation that solves operators' biggest pain points while improving your margins. When operators can save hundreds of thousands annually while reducing fraud and improving player experience, you become their indispensable partner, not just another PSP.

Momentum for Pay by Bank is building rapidly

The open banking payments market is experiencing explosive growth that directly benefits early-adopting PSPs.

Data from the latest Open Banking Limited (OBL) Impact Report shows that the number of successful open banking payments in the UK reached over 30 million per month as of March 2025. The average open banking payment value is £468, with total monthly value around £4.5 billion, demonstrating the substantial transaction values that make this particularly attractive for iGaming. This highlights how Pay by Bank is no longer a niche payment method — it’s becoming more mainstream all the time.

Now is the time to differentiate

The PSP landscape serving iGaming operators is intensely competitive, with providers competing primarily on pricing, reliability, and geographic coverage. Offering pay-ins using Pay by Bank gives you a genuine differentiation opportunity that goes beyond these traditional competitive factors — while actually improving your margins.

Here's what Pay by Bank delivers:

Win more operators: Few PSPs offer comprehensive open banking solutions yet. Position yourself as an innovator and win more iGaming accounts before your competitors catch up.

Revenue growth with lower costs: Increase revenue while reducing your processing cost base as card fees continue rising.

Justify premium pricing: Operators will pay more for services that demonstrably improve their conversion rates and eliminate fraud.

Geographic expansion opportunities: Support operator expansion across European markets with a single integration.

Yapily: The ideal open banking partner for PSPs serving iGaming operators

To build a truly great payment experience that iGaming operators will love, you need an infrastructure provider you can trust with significant experience in the space. At Yapily, we serve top PSPs like Noda and Yaspa, helping them gain a tangible competitive edge and scale payments that save operators thousands in fees and protect them from fraud.

Why PSPs serving iGaming choose Yapily

Extensive European coverage

With 2000+ bank connections across 19 European countries, Yapily enables you to offer Pay by Bank services to your iGaming operators wherever they operate. Rather than managing multiple regional providers or complex integrations, you get comprehensive coverage through a single partnership. This means you can win new clients across Europe and support your existing operators' expansion plans without additional technical overhead.

Infrastructure-first approach

Unlike aggregator models that obscure payment flows, Yapily's direct infrastructure approach gives you complete transparency and control over your Pay by Bank connections. You can monitor performance, troubleshoot issues, and optimise conversion rates at a granular level. For PSPs serving iGaming operators who demand real-time visibility into payment performance, this transparency is crucial for maintaining service levels and demonstrating value.

Expert onboarding and ongoing support

As open banking pioneers, we understand the nuances of payment integration better than anyone. Our specialist team provides dedicated onboarding support designed specifically for PSPs, ensuring you're live and processing payments in days or weeks, not months. Beyond launch, you get continued access to a specialist support package with experts who understand both the technical requirements and commercial opportunities in iGaming.

Flexible integration options

We offer two core integration models for complete flexibility and control over the user experience:

Hosted solution: Get to market quickly with our highly customisable Hosted Pages. Ideal for testing market demand or as an interim solution while you develop your white label integration. Many PSPs choose our hosted solution to demonstrate ROI to iGaming clients quickly.

White label direct integration: Build Pay by Bank directly into your payment flows with full branding control. Your operators see a seamless, branded experience that reinforces your position as their trusted payment provider. This is perfect for established PSPs ready to make open banking a core part of their offering.

Compliance-first architecture

Our platform is built with regulatory compliance at its core, reducing risk when serving highly regulated iGaming operators. We handle the complex compliance requirements across multiple jurisdictions, so you can focus on growing your business rather than navigating regulatory complexity.

Enterprise-ready

Our infrastructure platform is purpose-built for the demands of high-volume payments, delivering the resilience and high availability your operators expect. This means you can offer Pay by Bank with more confidence than traditional payment methods.

Get started with the future of payments in iGaming

The integration of open banking payments into your payment method portfolio represents more than a simple “nice ot have” — it's a strategic move to future-proof your business. With Pay by Bank transaction volumes nearly doubling year-over-year, the question isn't whether open banking will become a standard component of iGaming payment infrastructure — it's whether PSPs will position themselves as leaders in this transition.

At Yapily, we deliver comprehensive European coverage, enterprise-grade reliability, and a strong compliance approach that can enable you to turn deposits via Pay by Bank into a profit-driving reality. Our 2000+ bank connections across 19 countries, infrastructure-first approach, and flexible integration options mean you can offer Pay by Bank with complete confidence while maintaining full control over the user experience.

Join leading PSPs like Noda and Yaspa to start driving measurable ROI for your iGaming clients. Book a meeting with one of our open banking experts today to discover how Yapily can help you start winning more iGaming clients with demonstrably better conversion rates and lower costs.