We’re teaming up with B2B BNPL fintech Two to make it safer, cheaper, and faster than ever before for businesses to access credit.

Background

SMEs are the backbone of Europe’s economy. They account for almost two-thirds of European jobs and contributed approximately €3.5 trillion to the European economy in 2020. Yet, as reported by Allianz, industry research estimates that a €400bn SME finance gap still exists in Europe.

How are we working together?

We’re working with Two to ease the cash flow burden for SMEs by offering alternative ways to access credit with BNPL and open banking.

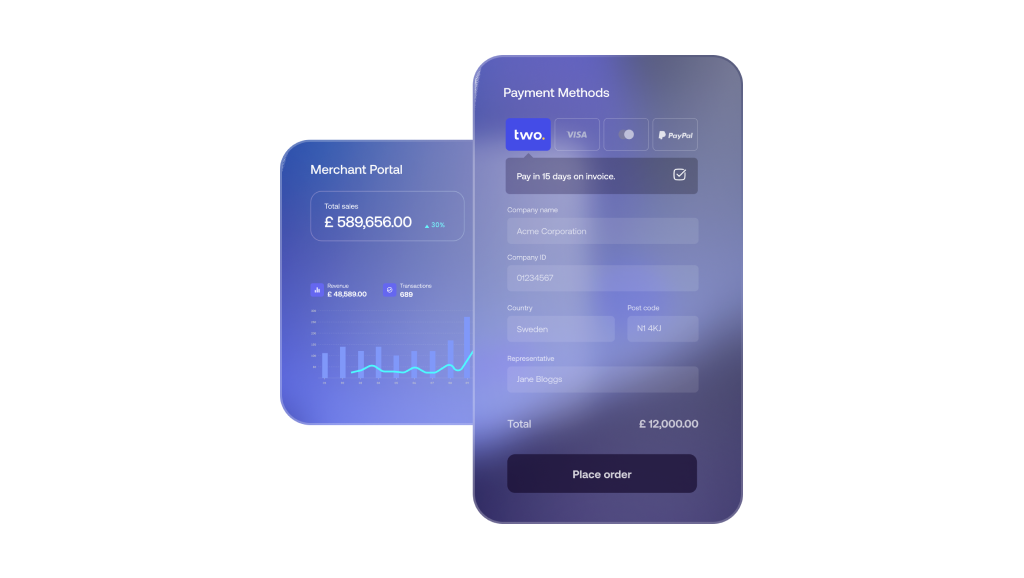

When a business purchases goods online, they can choose to pay via Two at checkout. Two then gives these business customers the option to pay between 14 - 90 days after purchase, providing them with flexible credit instantly. With the help of Yapily Data, Two can retrieve the buyer’s account information in real-time for instant ID verification checks and approval. This includes fetching user information such as name and date of birth, as well as transaction data, all without the need for endless forms.

During periods of cash flow gaps, SME owners no longer need to wait or turn to harmful short-term lending vehicles before making a vital purchase that could accelerate business growth. Businesses will also benefit from a more seamless online buying and selling experience, giving them more time to get back to what matters most: growing their business.

E-commerce platforms that offer Two as an accepted payment method can expect to see business customer approval rates rise by up to 90%; an increase in average order value up to 60%; and a 20% uplift in sales conversion rates.

“Many SMEs across Europe are in recovery mode after spending nearly two years dealing with an unpredictable economic climate. With Yapily and open banking, we can provide a safer, cheaper, and easier financial bridge for businesses that are ready to move forward. The intersection between BNPL and open banking is an exciting place to be. Together, we are shaping the future of financial services as we know it.” - Deane Barton, Head of Product at Two

“It’s great to see yet another innovative fintech company like Two challenging the status quo to deliver greater flexibility for businesses across Europe. This is a brilliant example of how open banking can help cash-strapped businesses at a time when they need it most. I’m very excited for our journey together and look forward to seeing what’s next.” - Stefano Vaccino, Founder and CEO at Yapily

Who are Two?

Two is fixing b-commerce, enabling merchants to offer Buy Now, Pay Later to their business customers at check-out with instant approval. They work relentlessly to make the process of buying for businesses as simple as it is for consumers to shop online. Over the long term, Two are on a mission to contribute to tens of millions of new jobs by speeding up the payments journey and supporting millions of SMEs to get paid straight away, so they no longer have to wait to get paid for goods and services they have already delivered.

The partnership will see open banking rolled out to Two customers across the UK, with more European markets to follow as the fintech continues to grow rapidly. It follows the news that we have agreed to acquire German open banking solution provider FinAPI to create the leading open banking platform in Europe.