Unlock the potential of your crypto business with open banking. Dive into our insightful guide on enhancing transaction security, streamlining KYC, and boosting operational efficiency in the cryptocurrency industry.

Crypto platforms are built for speed, but traditional fiat infrastructure often holds them back. Card payments, manual bank transfers, and legacy KYC processes create unnecessary friction across the user journey.

They’re expensive to run, prone to failure, and weren’t built to support the scale or speed of today’s crypto economy. What was once a niche sector has gone mainstream: in 2024, the global cryptocurrency market cap hit $3.9 trillion, with up to 900 million users expected by the end of 2025.¹

With that growth comes greater expectations for instant payments, seamless onboarding, and reliable infrastructure that can handle complexity across borders.

That’s where open banking comes in. It gives crypto platforms the infrastructure they need to move faster, stay compliant, and scale without relying on outdated payment rails.

In this article:

Looking to enable seamless deposits, reduce chargebacks, or automate compliance checks ASAP? Yapily can help: book a call to find out how.

Why open banking is a perfect fit for crypto

Here are five reasons for cryptocurrency platforms to offer open banking:

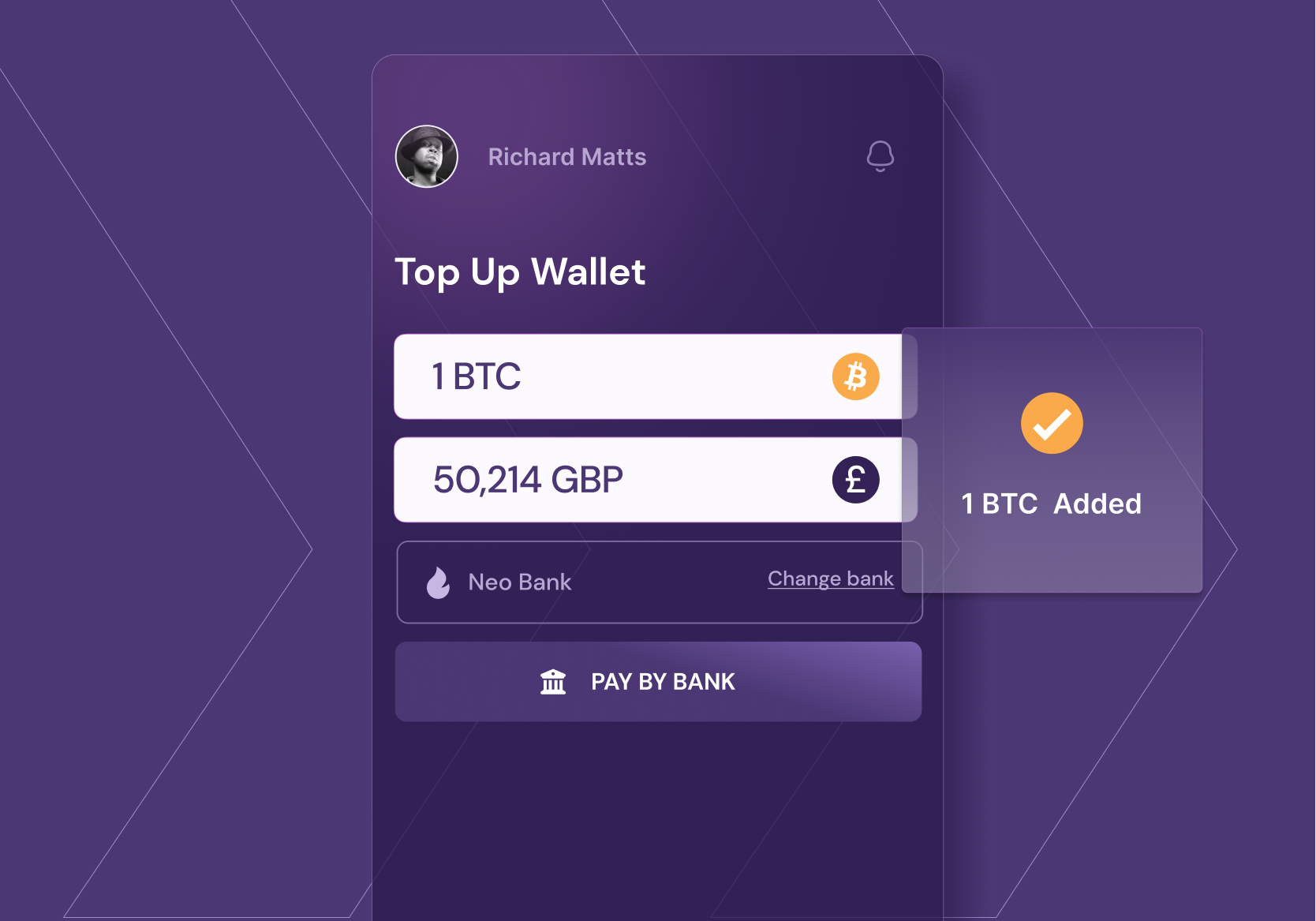

1. Faster wallet top-ups with account-to-account payments

Card payments are slow to settle and prone to rejection, especially in crypto. Open banking lets users move money directly from their bank to their wallet using trusted payment rails like Faster Payments (UK) or SEPA Instant (EU).

Users select their bank, authenticate via their banking app, and approve the payment in a few taps. The process is near-frictionless: no card details and no redirect to a third-party gateway.

For crypto platforms, this reduces drop-off at the point of funding, improves conversion, and gives users access to funds instantly, which is crucial in a world of fast-moving blockchain technology. There are no intermediaries or scheme-level risks, and no card-related decline logic to work around.

2. Lower transaction costs at scale

Crypto platforms often face inflated fees from payment processing vendors, card schemes, and acquirers. This isn’t cost effective, and can begin to significantly eat into margins.

With open banking, there are no interchange or scheme fees. Payments move directly between bank accounts, reducing transaction costs considerably when compared to credit cards or e-wallets.

And because these are push payments initiated by the user, they’re final, with no chargebacks, no disputes, and no forced refund workflows to manage.

*Open banking ‘refunds’ tend to be done using reverse payments. Find out more here: [Open banking reverse payments: What you need to know]

3. Real-time KYC and account ownership verification

KYC is a major cost centre for crypto companies. Manual reviews, document uploads, and identity verification tools can create onboarding friction that loses users.

Open banking changes that. With consent, crypto platforms can retrieve a user’s name, IBAN, and account details directly from their bank. No document uploads. No manual review queues. Just verified data , right from the source.

Yapily Validate enables this in real time, helping you confirm account ownership and reduce identity fraud without adding extra steps to onboarding. That means faster approvals, fewer failed deposits, and a cleaner audit trail for regulators.

4. Stronger security and lower fraud risk

Card fraud and chargebacks are a known issue in crypto exchanges, such as when wallets are funded using stolen credentials. Open banking eliminates that risk.

All payments are authenticated by the user through their own banking app using Strong Customer Authentication (SCA). The platform never handles card data. There’s no credential sharing, and no way to reverse a payment once approved. This means you don’t need to worry about so-called ‘friendly fraud’, like chargebacks and disputes.

This closed-loop flow also supports source-of-funds verification. You know where the money is coming from, and that it belongs to the verified user. That’s powerful in an environment where AML controls, Travel Rule compliance, and fund traceability are non-negotiable.

5. Infrastructure that scales with your business

Crypto platforms are expanding across geographies, user types, and even regulatory frameworks. For instance, in 2025, the EU’s MiCA regulation introduced mandatory licensing and harmonised compliance rules for all crypto service providers—creating a unified framework across 27 countries.2

This marks a shift from fragmented national rules to centralised oversight, raising the bar for how crypto companies manage compliance, onboarding, and payments at scale. To meet these demands, platforms need infrastructure that’s not only scalable, but built with regulation in mind.

Open banking offers exactly that: API-first, compliance-ready rails that support high-volume flows, multi-entity support, and real-time monitoring.

What to look for in an open banking solution for crypto

If you’re looking to offer open banking for crypto you should look for the following features in an open banking solution.

Developer-first integration: No bloated SDKs or rigid redirect flows. Look for a provider that gives you full control over UX and lets you build around your product. That being said, if you want to get to market quickly, your provider should also offer a hosted solution.

Coverage across consumer and business accounts: Many open banking APIs only work for personal accounts. If you serve institutional clients or offer B2B flows, make sure your provider supports business account verification and payments across markets.

Real-time visibility and monitoring: You need to know, in real-time, when a bank changes behaviour, an Application Programming Interface (API) fails, or a payment stalls.

Unified data and payments: Managing separate integrations for KYC (powered by open banking AIS) and payments adds overhead and risk. The ideal partner gives you access to both through one API and one contract.

Choose a provider that understands the speed, scale, and regulatory pressure of crypto, and is built to handle it.

Why crypto platforms are choosing Yapily

Yapily is the open banking infrastructure partner behind some of the fastest-growing crypto platforms in the UK and Europe. Our API-first platform enables you to build secure, scalable fiat rails that support real-time payments, identity verification, and compliance—all through a single integration.

Whether you’re looking to reduce payment friction, speed up onboarding, or expand across markets, Yapily gives you the tools to do it, without compromising on control or functionality.

Here’s what you get when you use Yapily:

1. Developer-first infrastructure, with full control over your UX

Yapily provides pure infrastructure with no branded overlays or rigid user flows, giving you complete freedom to design a user experience that fits your platform.

Our lightweight, well-documented API gives you the flexibility to launch quickly, iterate fast, and scale with confidence. While we’re working on your white-label solution, you can use our Hosted Solutions to get started with open banking right away.

2. Broad coverage across nearly 2,000 banks in 19 countries

We connect to nearly 2,000 banks and financial institutions across 19 European countries, supporting both consumer and business accounts. Users can fund wallets instantly using trusted rails like Faster Payments and SEPA Instant, reducing drop-off and increasing conversions.

For onboarding, Yapily Validate enables you to access rapid and secure real-time account verification. With user consent, you can retrieve key financial information like name, IBAN, and account details directly from the bank, eliminating the need for more manual KYC checks or document uploads.

For even more insight, our Data Plus product provides enriched financial data, including transaction categorisation, merchant names, and balances. That’s useful for AML checks, source-of-funds verification, and building more intelligent user flows.

3. A single integration for payments, data, and scale

As both a Payment Initiation Service Provider (PISP) and Account Information Service Provider (AISP), Yapily provides unified access to open banking payments and open banking data. You get both capabilities through a single API and contract: simplifying integration, vendor management, and compliance.

Our infrastructure is designed to support high-volume, cross-border activity with consistent uptime, real-time monitoring, and built-in error handling. Yapily powers over 3,500 live applications, supporting use cases across crypto exchanges, lending, and a broad spectrum of financial products, spanning both traditional and digital finance.

We’re ISO 27001 certified and PSD2 compliant, giving you the peace of mind that your platform is secure, resilient, and built to meet strict regulatory standards.

Ready to build faster, smarter crypto infrastructure?

Whether you’re looking to enable instant wallet funding, automate onboarding, or scale across borders, Yapily gives you the open banking rails to do it securely and at speed.

Try a demo to see how it works, or book a call with our team to discuss your use case in more detail.

Sources: 1 https://crypto.com/en/research/2024-review-2025-ahead

2https://crystalintelligence.com/crypto-regulations/pwc-global-crypto-regulation-trends-for-2025