Here, we’ll explore four key sweeping use cases businesses are using to build better financial products for consumers with variable recurring payments.

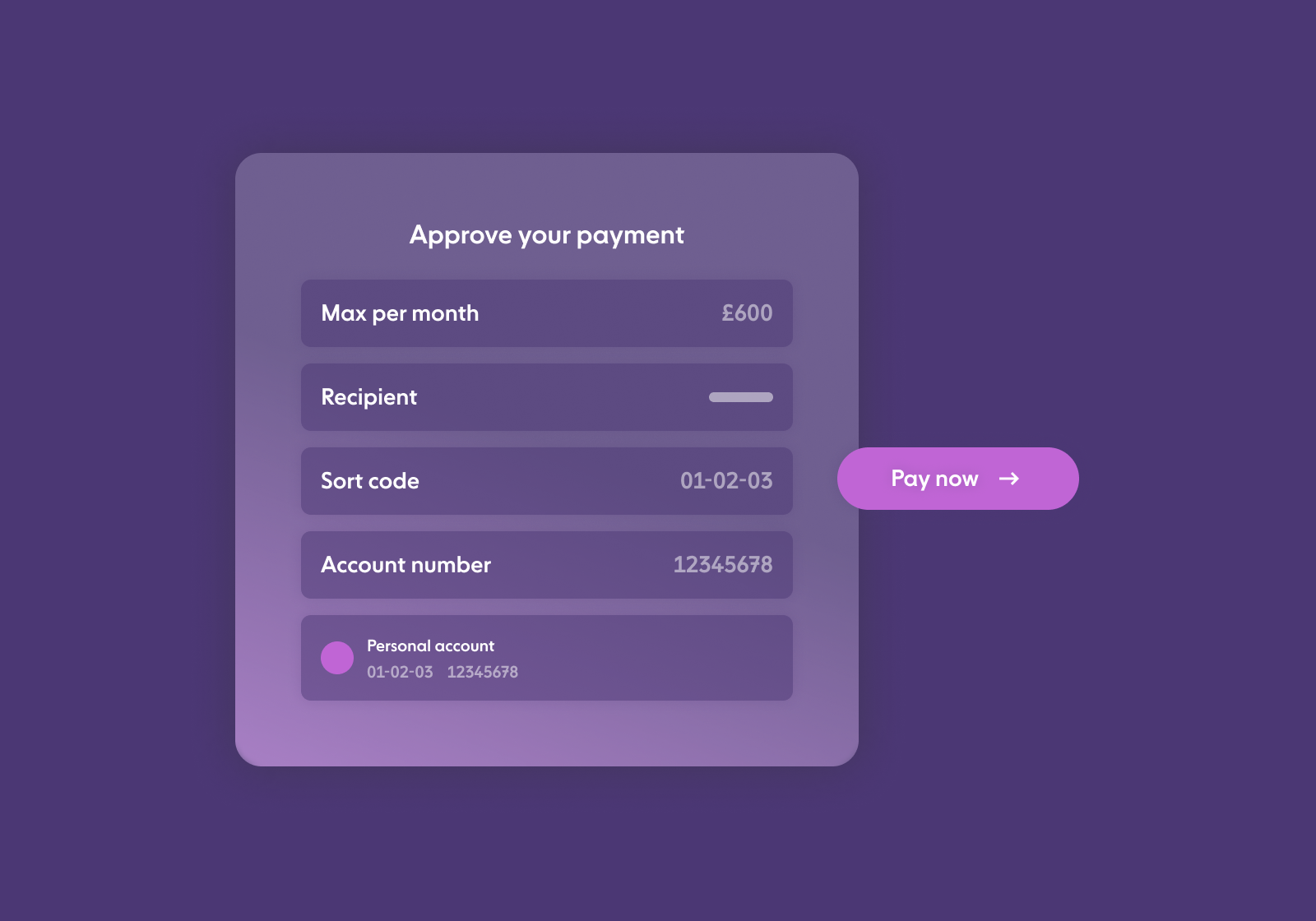

Variable recurring payments (VRPs) enable businesses to collect regular payments using open banking, and offer businesses and consumers a powerful way to automate their finances and improve their financial wellbeing.

A faster, more secure alternative to direct debit, VRPs can help consumers save money, avoid fees, and manage their money more effectively. Whether it’s automating savings, paying off loans, or switching to higher interest bearing accounts, VRPs can help us all achieve our financial goals with greater ease and convenience.

Want to learn more about the difference between Direct Debit and VRPs? Click here.

It’s important to note that there are two types of VRPs: sweeping and non-sweeping.

Sweeping gives consumers and businesses a simpler and faster way to move money between their own accounts, allowing them to manage their finances with ease and convenience through automation.

While banks aren’t yet required to provide Commercial VRPs (or non-sweeping VRPs), some banks, like NatWest, are ahead of the curve and support money movement between two separate accounts to rival direct debit and card-on-file payments.

Get equipped with Commercial VRPs and their use cases! Explore how they could be the optimal way to simplify utility bill and subscriptions payments, as well as the advantages for both merchant and user.

In this blog, we’ll explore four key sweeping use cases businesses are using to build better financial products for consumers.

Intelligent savings

One of the most significant benefits of VRPs is their ability to automate savings. With VRPs, consumers can set-up automatic transfers to savings accounts based on specific rules, such as a percentage of their income or a fixed amount each month. This allows consumers to save without having to think about it actively, maximising the potential of their savings accounts.

For example, a consumer could set-up a VRP to transfer 10% of their income to a high-interest savings account each month. This would ensure that they are consistently saving without having to remember to make transfers manually. VRPs can also be used to transfer money to different savings accounts based on specific goals, such as a down payment on a house or a vacation fund.

Smart overdrafts

Overdrafts can be a financial burden for many consumers, often resulting in high fees and interest charges. VRPs can help automate the repayment of outstanding overdrafts by transferring money from another account with a positive balance. This can help consumers avoid overdraft fees and make their money work harder across all of their accounts.

For example, a consumer could set-up a VRP to automatically transfer funds from their savings account to their current account if their balance falls below a certain threshold. This would help them avoid overdraft fees and minimise the impact on their credit score.

Paying off credit and loans

VRPs can also be used to automate the repayment of unsecured loans and credit balances. This can help consumers stay on top of their payments and avoid late fees, while also reducing the overall interest paid on their loans and credit balances.

Here’s an example:a consumer could set-up a VRP to automatically pay off their credit card balance based on their affordability each month. This would ensure that they never miss a payment and avoid late fees. Additionally, if they have a personal loan, they could set-up a VRP to automatically transfer the monthly payment from their current account to the loan account.

Current account switching

Finally, VRPs can be used to encourage consumers to switch to higher interest bearing current accounts by automating the movement of funds. This can help consumers improve their financial wellbeing by earning more interest on their savings and reducing their overall banking fees.

A consumer could set-up a VRP to automatically transfer their monthly paycheck to a high-interest bearing current account. This would ensure that they are earning the maximum amount of interest on their money. As an added bonus, this will also incentivise banks to provide better savings rates to prevent their customers from switching to other alternatives.

Want to explore Sweeping VRPs for your business?

Unlike card or debit payments that take days to settle and are expensive, Yapily Variable Recurring Payments settle instantly and put consumers across industries in control of their cash flow and payment operations.

And, thanks to embedded Strong Customer Authentication (SCA) and long-lived consent, merchants and their customers can rest assured that all recurring payments will be safe and secure.