Open Banking usage has increased significantly since the start of the pandemic. In the UK alone, the OBIE reports that over 3 million consumers now use Open Banking-enabled products and services to improve their financial wellbeing, and more and more countries are harnessing the power of Open Banking to enable better and fairer financial services.

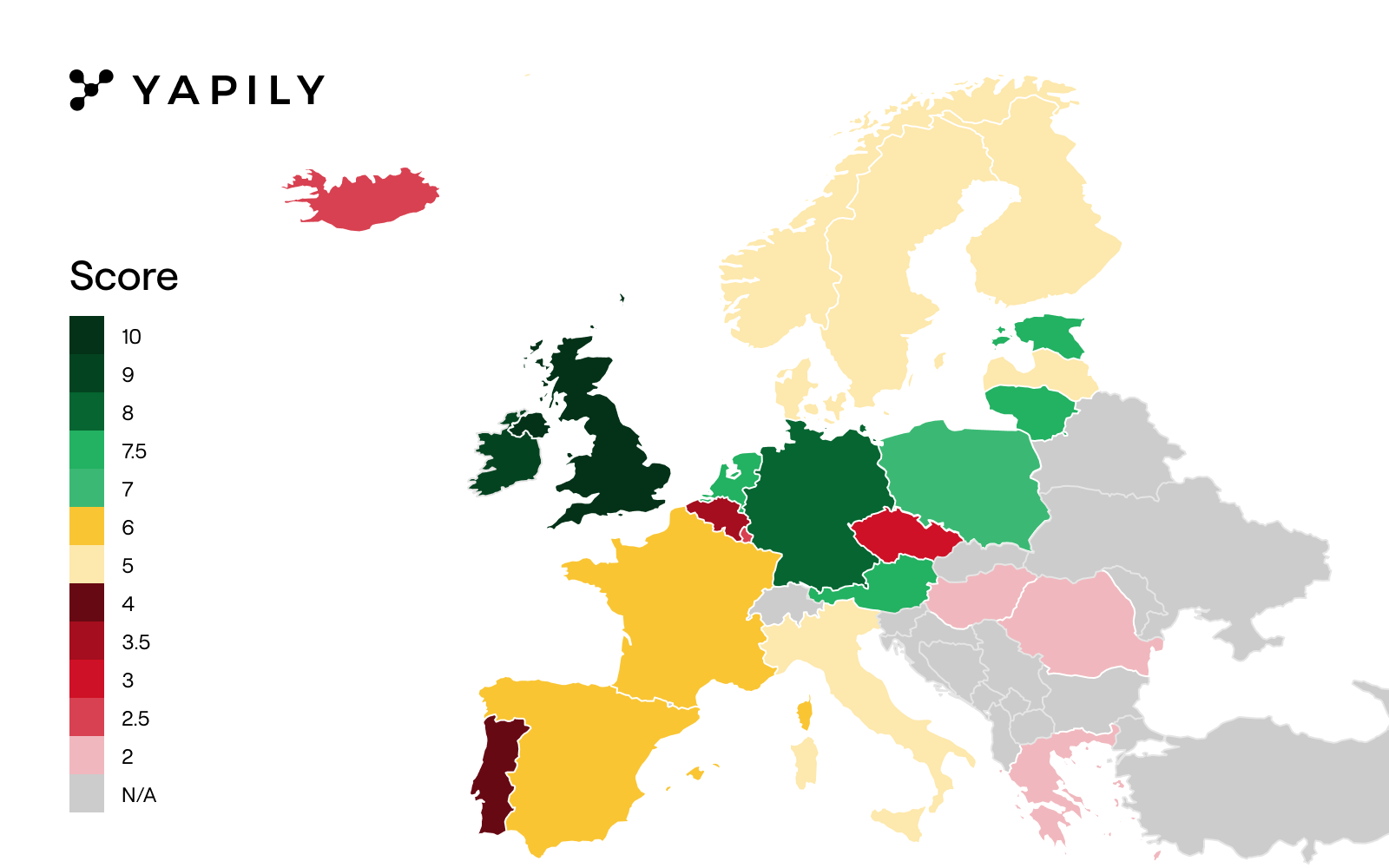

But while the market has a rough idea of who is winning the metaphorical league and who is missing the net, no-one really knows what the actual picture looks like across Europe. Or what this means for the future of Open Banking adoption. Yapily’s European Open Banking league table provides this comprehensive overview of the market.

The league table - based on data compiled in 2021 by Yapily through its EU-wide Open Banking API infrastructure and monitoring tools - reveals that while parts of the EU are making positive strides to drive Open Banking adoption and are on track to evolve into Open Finance, others are far behind and missing their scoring opportunity.

Each country has been ranked based on levels of supervision and enforcement by the member state, the presence of Open Banking from a technical standard, regulator interpretation, API standards and bank readiness, and overall product score. Yapily has also shared regulatory insight on where and how each country can positively improve their overall score and ranking.

Andria Evripidou, Policy Lead at Yapily comments on the data, “The league table demonstrates the positive impact Open Banking adoption has across markets and highlights that the ecosystem as a whole, is on the right path to offering fairer financial services for everyone.

“While some countries have a bigger presence, over the next few years, we will start to see standardised technical requirements that map customer journeys across all countries and better educate industries on Open Banking, as well as the direction of the ecosystem.

“Ultimately, all countries are working towards a common goal - to evolve with Open Finance - and at Yapily, we’re excited to watch the rest of Europe dive forward with this innovation.”

Country | Detail | Score | Improvements |

|---|---|---|---|

UK | Yapily’s data reveals that the UK comes out on top as the leading adopter of Open Banking, with it’s clear functionality and more widespread mandating of interesting features, such as Bulk Payments and VRP (variable recurring payments). | 10 | Open Banking has been implemented successfully in the UK. The focus should now be on fixing some of the remaining issues in the technical implementation. Additionally, the industry would benefit from a roadmap to further the implementation of Open Finance. |

Ireland | Ireland’s Open Banking success is very similar to the UK’s, in the sense of regulation and adoption. As a result of Brexit, many UK businesses have set up satellites or a main base in Ireland. However, given the mix of UK and Berlin group standard that a few banks use, there is some complexity when integrating with a wide variety of banks in Ireland. | 9 | Ireland has closely followed the UK with regards to the implementation of Open Banking. However, in Ireland an entity that is similar to the OBIE has not yet been formed and would potentially add great value to the wider ecosystem. An OBIE-like entity could support Irish companies in implementing technical specifications and drive adoption rates forward by increasing the trust in the ecosystem. |

Germany | Germany also ranks high as it has strong regulatory supervision and uses Berlin Group’s API - the most prescriptive after UK Open Banking. However, it has low guidance provided around the implementation of Open Banking and could do with support on issuing regulatory guidelines around user journeys and customer authentication. | 8 | Germany’s slow adoption rate of Open Banking is generally due to two factors. The first being poor guidance on the appropriate implementation of Open Banking, leading to various interpretations. Secondly, cultural attitudes towards using digital payment methods. On the public policy side, the regulatory bodies can do better at increasing the awareness of the benefits attached to Open Banking. |

Netherlands | Although the Netherlands use the Berlin Group standard for Open Banking, regulatory supervision is comprehensive. There is also wide scale adoption of PIS amongst the population. | 8 | In the Netherlands, the use of PIS is widely adopted through iDeal - a PIS provider. However, AIS has not been as widely adopted and consumers remain sceptical about its benefits. Our recommendation would be for the regulator to try and open up the market to more TPPs, increasing competition by lowering legislative barriers to entry and do more work on increasing awareness on the security features of Open Banking. |

Austria | Austria is very similar to the German market and Open Banking standard, automatically scoring them quite high. However, there is no industry body like the OBIE in Austria but they do have powerful associations in the Open Banking space driving standardisation. | 7.5 | The regulator could work more closely with the industry to deliver guidelines that match the ecosystem’s requirements. This could be done through working relevant associations or through consultations that can be used to understand the gaps that need to be covered, in order for TPPs to be able to offer a wider range of Open Banking products/services. |

Estonia | Estonia has been trying to bring in a lot of foreign investment since Brexit, hence they have invested in developing a fertile regulatory environment for foreign firms. Open Banking has been one of the selling points/central areas of attention for regulators there. However, despite sharing a number of banks with many of the Baltic/Nordic regions, implementations vary, making connectivity slightly more tricky. | 7.5 | Regulators should mandate a set of common technical standards that are more similar to the ones used around the EU. Even though Open Banking authorisation is relatively streamlined in Estonia, authorities should focus on ensuring that firms meet the legal requirements once authorised and enforce against poor quality API performance. |

Lithuania | Similarly to Estonia, Lithuania has developed a strong Fintech movement with many UK firms setting up European bases in Vilnius. You can expect Fintechs to continue the push for innovation, supported by regulators and banks. | 7.5 | Lithuania, in a similar way to Estonia, has made authorisation guidelines simple and easy to understand, which have supported market entrants. However, more attention needs to be paid in standardising consumer journeys and developing a set of regulatory guidelines specific to UX would be a considerable improvement for the market. |

Poland | Open Banking is definitely a high priority in Poland. There is a strong sense of cooperation between industry and regulators. There is some guidance formed around the Polish API standard, however it is extremely bespoke making implementation difficult. | 7 | Regulatory authorities could focus on delivering API specifications that are closer to the ones used by most EU countries. They could also focus on stricter enforcement of PSD2 standards as the current implementation is patchy. |

France | The STET framework is used throughout France for Open Banking, it can have different interpretations by banks, which has led to discrepancies in implementation. On the whole, feature coverage is good but there are limitations. | 6 | France’s legislative framework is quite complicated and has a strong focus on AML. To support the adoption of Open Banking, regulators could provide more guidance to firms on how best to meet legislative requirements. Currently, firms in France have to meet quite strict regulatory requirements in order to be authorised, these are not always proportionate to the risk profile of a company. |

Spain | Although Spain uses the Berlin group standard, Redsys API gateway makes it easy to integrate in Spain. But, there are many variations between banks, meaning it is harder to normalise across integrations. | 6 | Even though regulatory bodies have welcomed PSD2 and Open Banking in Spain, the supervision and enforcement of the rules have been very weak. A stricter approach whereby the regulators collect real data around API availability and adherence to legal requirements, followed by enforcement against breaches of these rules, would ensure that OB journeys are streamlined therefore accelerating adoption. |

Italy | Italy has very low supervision of Open Banking standards and a very slow regulatory response. PSD2 was adopted, however no changes were made or added to the original legislation around Open Banking. Italy uses the Berlin groups standard, but general payments implementation (outside of single domestic payments) is very poor. | 5 | Italy needs a speedier and more agile regulatory approach for Open Banking to take off. The regulator could set-up a dedicated Open Banking support team to help firms navigate the regulatory environment or provide guidance to PSD2 implementation. |

Denmark | Denmark has good regulatory supervision with some guidance provided around implementation. However, it has no industry body, to help centralise standardisation and drive technical standards. This is something they will most likely be implementing in the coming years. | 5 | Given the existing direction of Denmark and it’s welcoming approach to Open Banking, regulators should start focusing on how Open Banking will become interoperable with Open Finance. Regulators could provide a roadmap to start preparing TPPs on how to adjust their internal systems, in a way that would allow them to integrate with other financial providers beyond banks as features become available. |

Norway, Sweden & Finland | These three countries have good regulatory supervision with some guidance provided around Open Banking implementation. However, there is no OBIE-like body, to help centralise standardisation and drive technical standards. | 5 | An OBIE-like body would add a lot of value to the ecosystem as it would help clarify any remaining issues around the implementation of Open Banking and how the industry could address more use cases, which at the moment are limited in these countries. |

Latvia | Although Open Banking is not a regulatory priority, Latvia does share banks with many baltic and nordic states. | 5 | Regulators should develop a set of guidelines on what is expected from TPPs. This would reduce uncertainty and provide an incentive for more firms to either enter the market or adopt Open Banking. |

Portugal | Regulators have worked with the industry to progress standardisation of technical standards, despite this, banks and firms are yet to widely adopt Open Banking. | 4.5 | In Portugal the main barrier to Open Banking adoption is the incumbent banks approach to supporting TPPs. Regulators need to prescribe stricter SLAs for banks to meet. For example, TPPs should be able to resolve issues and outages with banks, within 3 working days. Regulators should also collect more data and supervise API availability more closely. Removing any artificial barriers raised in consumer journeys that make it easier to use a card instead of Open Banking when making a payment will also aid adoption in Portugal. |

Belgium | Regulatory support for Open Banking in Belgium is very slow. Regulatory supervision and guidance around implementation is very minimal. | 4 | Similar to other EU countries, a swifter approach to enforcing PSD2 standards would benefit the implementation of Open Banking. At the moment, Open Banking complaints or notifications are slow to be answered and incumbents have made Open Banking journeys more difficult. Regulators need to specify more detailed criteria for TPPs and banks to understand how user journeys should look and feel. |

Czech Republic | Open Banking is a very low priority for regulators and there is no guidance around implementation. | 3.5 | Due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. Any other approach would be too slow to deliver considerable benefits within a reasonable timeframe. |

Iceland | Open Banking is a very low priority for regulators and there is no guidance around implementation. | 3 | Iceland has a relatively small financial system. As such, industry coordination becomes easier. The regulatory bodies could move quicker in providing a set of minimum standards and expectations on how Open Banking should be implemented and then allow the industry to develop its own solutions by a specified deadline. |

Luxembourg | Open Banking is a very low priority for regulators and there is no guidance around implementation. | 3 | Due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. Any other approach would be too slow to deliver considerable benefits in a reasonable timeframe. |

Greece | Open Banking is a very low priority for regulators and there is no guidance around implementation. | 2.5 | Due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. Any other approach would be too slow to deliver considerable benefits in a reasonable timeframe. |

Romania | Open Banking is a very low priority for regulators and there is no guidance around implementation. | 2 | Due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. Any other approach would be too slow to deliver considerable benefits in a reasonable timeframe. |

Hungary | Open Banking is a very low priority for regulators and there is no guidance around implementation. | 2 | Due to the low interest in this area, the best way to move forward would be to set-up an OBIE-like entity to standardise technical requirements and consumer journeys. This would ensure that all industry participants are aware of the direction of the ecosystem. Any other approach would be too slow to deliver considerable benefits in a reasonable timeframe. |